Interview with Ricky Volpe, PhD, of California Polytechnic State University, San Luis Obispo

We recently sat down with Professor Ricky Volpe from California Polytechnic State University, San Luis Obispo (Cal Poly) College of Agriculture, Food and Environmental Science’s Department of Agribusiness to learn about his specific interest in the food retail sector. We were interested to hear his perspective as an economist on food price inflation, food supply chain shocks, and how both the COVID-19 pandemic and climate change pose risks and opportunities for the industry in the U.S. Read on to learn Professor Volpe’s top strategies for retailers coping with supply chain shocks and changing consumer preferences, as well as how he connects his students to the industry and the innovative results they help produce.

This interview was edited for clarity and concision.

What are the core questions that your research focuses on, and how do they relate to food retail sustainability?

The longer I’ve been in the research game, the more my research has pivoted toward just one topic, which is the economic impact of food retailing. It also deals with the economic impact of the food supply chain, since my interests relate to food manufacturers and distributors. But the industry that I’m most interested in, the one I know the best, is retailing.

I’m increasingly interested in what we know and what we can learn about the impacts the industry has on consumers, upstream supply chain stakeholders, lateral industrial sectors, prices, costs, and environmental stewardship. Nearly every project that I’m involved in and have been involved in over the last 5–6 years touches on the impacts of food retail in some way.

The way you phrase food retail’s impact on lateral industries reminds me of the talk that you gave recently at Tufts Friedman School of Nutrition Science and Policy, where you compared the food supply chain to the Colorado River, in that the river’s headwaters are the farms and farmers, and then as you go down the river, you go through the steps of food processing, manufacturing, and transportation until you reach the Sea of Cortez, representing the food retailer. What role do food retailers have in reducing the impact of the food they sell on this journey?

Oh, absolutely a tremendous amount, because the structure of the food supply chain has changed immensely in the last 50 years, and some of the most acute changes really happened more recently, in the past 20 to 30 years. What I’m mostly talking about is consolidation. It’s something that most consumers are only tangentially aware of. They aren’t super concerned about the structure of this industry and its supply chains, but consolidation has transformed the food supply chain—and, in my view, has done so most dramatically in retail.

Whereas changes in production have occurred at the other end of the food supply chain, upstream, with the rise of co-ops and corporate farms, they’ve had nowhere near the same impact in terms of total capacity, market power, and pricing power. What this means is that we understand that what’s going on with food prices—price variation and then product availability, depth, and breadth in the supermarket—largely pertains to the strategic and competitive decisions that these retailers are making. In my view, and based on the evidence that I’m aware of, it’s shortsighted to think that retailers are just the end of the supply chain and they’re selling the food. What you see and how it’s priced is a function of where it came from. Food retailers now play a major role in all the factors involved in the various steps along the supply chain. The bigger the retailer company, the bigger their impacts are and the more they matter. Retailers have a clear idea of what they want to sell in their stores, and that is something that gets worked out through their relationships with their suppliers. Their suppliers could be wholesalers, distributors, or consumer product goods (CPG) manufacturers. In some cases, retailers are the grower and shipper themselves, but retailer firm size is playing a very key role in what the upstream companies are making, how they’re making it, what their cost structure looks like, what their sourcing looks like, and other factors affecting what they have on their shelves, and that’s how the food-at-home [grocery] supply chain works these days.

So, what you’re saying is that because of the sheer power that they’ve accumulated through different consolidations, they can have a lot of impact? Could you provide a few examples?

Costco’s model is maybe the most obvious, because a lot of manufacturers and vendors develop product formulations and package sizes that are specific to Costco, and nobody would do that if they didn’t understand it to be worthwhile to get on the shelves of this major retailer and gain that sort of exposure.

With Walmart, a lot more happens behind the scenes, but it’s understood that Walmart has a manual that they share with all of their suppliers. It spells out all of the regulations and rules that apply to their suppliers in detail, in terms of meeting shipping commitments and timing requirements. Walmart is so big that, for example, there’s a Walmart-sized pallet that has different dimensions than industry-wide pallets, and it’s because Walmart is so driven by efficiency. Through research, they have determined that this pallet size is a better fit for their docks and allows for fewer labor hours per shipment, so if you’re a large CPG company and you’re shipping to Walmart, you’re using the Walmart pallets. It’s amazing to think that a supplier would actually use a unique kind of pallet for their shipment, but they know it’s worth it to be with Walmart. This is just one example of how the influence of retailers plays out.

And it’s not just the biggest companies who exert this influence, though a lot of people have the idea that independent grocers have no buying power. Don’t get me wrong; they don’t have the same kind of buying power as these national chains, but most independent grocers are members of much larger trade associations like the National Grocers Association or, locally, the California Grocers Association. These associations not only serve as a voice for these retailers in terms of upcoming regulations and legislation, but they also serve as sort of an umbrella that helps increase independent grocers’ buying power, source private labels, and such. The dynamic wherein the retailer has upstream influences exists across the spectrum of firm size.

The idea that retailer associations can also have a huge impact on food retail operations and supply chain dynamics is such an important point. Separate from firm size, another helpful notion from your talk at the Tufts Friedman school is the defining of “deep COVID”: that eerie time from March to July of 2020 that brought such serious shocks to the supply chain. Based on your research, are there any factors that you think either made or perhaps continue to make food retailers vulnerable to those kinds of serious disruptions?

So, I think really all COVID did was shine a light on vulnerabilities that were already there. COVID revealed three very important rigidities in the food supply chain in terms of how retailing links to the rest of the food supply chain: product sourcing, particularly for specialty crops; labor; and then truck capacity.

Specialty crops are foods like perishables—fruits, vegetables, meats, tree nuts—and the intermediate products made from them. The issue was that in the U.S., specialty crops and the labor associated with them have become deeply specialized into marketing channels. These channels are based on the supplier/buyer relationship, but broadly, in terms of producing, shipping, and moving food, the channels largely result from an effort to reduce uncertainty and lower transaction costs. So, most specialty crop suppliers have a dedicated foodservice channel and a dedicated grocery channel, or even only one or the other. Then COVID showed us that the wall between the two channels—grocery and foodservice—is not very permeable. At least, it wasn’t when COVID hit in spring 2020, and that’s problematic, in my view.

Then labor became another issue as COVID hit overnight. The retail sector had a desperate need for labor and the food service sector had a surplus of labor, to the point where people were getting laid off. Eventually the United Food and Commercial Workers (UFCW) and other organizations arranged for a partial melding of the two sector channels so there would be some labor crossover, and that proved effective. A lot of food retailers deployed creative strategies for expanding and enhancing their labor pool during COVID, but it became clear that it was very difficult for labor to go from one channel to the other.

And then, finally, truck transportation became yet another issue, as my talk covered thoroughly. I don’t have the solution to our trucking issues, and I don’t know anybody who does, but I can tell you that COVID made clear that we don’t have any slack in terms of refrigerated truck transportation in the U.S., and the situation is only getting worse.

Right—I remember thinking, during your talk, that I had no idea of the extent of the truck shortage as it relates to the food supply chain. Can you speak further to that?

Yes, the issue is that trucking rates are going up, yet truck availability is going down, and those two trends just keep on spiraling. One might say, “Well, you know, a lot of the big retailers and the big CPG companies and manufacturers, they own their own fleets of trucks.” Yes, that helps. But they don’t have enough drivers, and the issue of slack is going to continue because we do not have any surplus of truck capacity at any given point in the supply chain. And so, if there’s a surplus of food, or if there’s an unexpected demand for food, like in spring 2020, there won’t be any trucks available to address it, and we’ll continue to waste crops while retailers incur unexpected costs.

One bright spot I’ve noticed is that, for smaller-sized retailers who may not own their own truck fleet, a lot of those regional retailers work directly with third-party logistics companies to help solve this inefficiency in the supply chain. These companies are non-asset-based and their business model involves working with enormous numbers of truck capacity providers, agricultural producers, CPG companies, wholesalers, and retailers. So, they have this enormous digital Rolodex, and their job is to just put the pieces together. They play a major role in enhancing driving efficiency, and it opens up a lot of opportunities for smaller players who may feel restricted to a single capacity provider based on their geographic location. This is something that I hope more retailers learn about and get involved in, because in my view, it can only drive efficiency and increase options for retailers who are looking for the capacity to make that last journey segment and get their food on shelves. This type of efficiency also reduces spoilage and associated emissions from that food waste, so it’s a win-win for retailers, suppliers, and the climate.

Do you think we will see another price surge this winter like we did during deep COVID, spring 2020?

Oh no, I am not predicting food price inflation. There are a lot of headlines out there about how inflation in the U.S. is hitting a 31-year high. But it really depends on which consumer pricing index you’re talking about, and which time frame you’re comparing.

Here’s a very quick lesson on the Consumer Price Index (CPI): The U.S. Bureau of Labor Statistics (BLS) defines the items that make up the All Items CPI (CPI-U). The CPI-U is a measure of the changes in the value of the U.S. dollar. Economy-wide inflation occurs as the CPI-U goes up, meaning the value of the U.S. dollar goes down. There’s no way around that. This means that over any time of interest—say, from the year 2000 to today—you can calculate the percentage change in the CPI-U, which gives you the level of overall inflation.

Then, here’s where it gets good: You can pick any other CPI you want and compare it to the CPI-U. The CPIs that interest me specific to food retailing are pricing for “food at home” (FAH) and “food away from home” (FAFH). If your chosen index is more than the CPI-U, it has increased in real terms. If it’s less, it has decreased in real terms, meaning that your dollar goes further on those purchases. I always tell people that if you ever want to know what’s really going on with prices for automobiles, healthcare, anything, you can do that exercise to educate yourself.

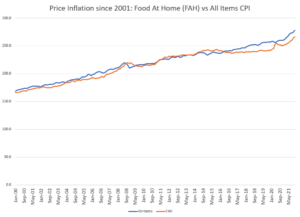

Let me help you visualize this. I made this graph for the class I’m teaching:

I put this graph together to depict the CPI-U pricing index (labeled as “All Items”) and the FAH pricing index—the price on a typical grocery basket for food to eat at home. If you look at actual annual inflation over previous calendar years, this graph shows that food price inflation (labeled as FAH) has been trending down for a long time. This means that the real term increase in what we’re paying for all goods and services has been slowing down—and in some cases, even reversing. We need to remember when we see headlines that compare October to October, it’s not just that prices were high in October of 2021, it’s also a function of the fact that prices were low in October of 2020. That’s the sort of perspective that lets us dig beyond the headlines, and it shows why it’s important to expand our time frames to see the real trend.

Thanks for walking me through that. It’s a helpful process to know about, especially for food retailers. So, do you feel like there are correlations with the shorter-term volatility from the pandemic and then longer-term impacts of climate change for food retailers?

Yeah, I knew we’d get to this eventually. Do you mean whether there are ways that I think food retailers could be engaging their supply chains to adapt to this kind of new reality?

Yes, through the research you’re doing alongside food retailers, and your students’ work on the ground with different businesses, what are some of those strategies or takeaways that have come up, if any?

My number-one strategy for food retailers: All of them need to get better at data. I mean creating data, storing data, analyzing data, and using it to understand what has happened, to predict what will happen, and to make forecasts about what’s coming. I do think a lot of retailers still make very important decisions more or less shooting from the hip, so there’s a lot of inefficiency and mistakes that can be, if not completely avoided, mitigated by analyzing data. Studying data can help us better understand what sales look like and how they are affected by seasonality, by severe weather, by the promotions that we offer, by the promotions our competitors offer.

In turn, this will lead to making better decisions about sourcing and pricing that can go a long way toward reducing both the hard costs of food waste and the soft costs of unmet demand. So, when a retailer calls me up, that’s usually the number-one thing I say—get into your data, get somebody in the organization who’s good at it and who’s going to focus on it. And it’s not super high-level stuff, but a lot of retailers aren’t even clearing that bar, and it’s the sort of thing that I’ve offered to help with myself, but understandably, most retailers keep their cards pretty close to the vest. Yet data is key to being able to offer tangible recommendations. It is the number-one strategy for adapting to COVID, and longer-term, to climate change.

Indeed, in an industry with so many moving parts, data is so critical in establishing that type of baseline. Where do you think data can be most helpful, like in establishing a baseline or predicting future conditions? How have you seen it applied, or do you have ideas of how retailers could use data in new ways?

My understanding is that companies like Walmart and Costco waste significantly less food per store, per customer, and per transaction than a lot of their competitors. Now, that’s not driven entirely by altruistic environmental stewardship. It’s because food waste is expensive. The drive for lower costs and efficiency aligns with global concerns about the environment.

But how do they do it? It’s not by being willing to eat those soft costs by disappointing consumers who wanted an avocado but couldn’t find one on the shelf.

It’s largely the adoption of a data-driven approach to inventory management that has greatly reduced inefficiencies. This means using satellite systems, barcodes, scanners, and blockchain to gain a precise measure of how much you have in the store, how much is in the distribution center, how much is in transit, and how much latent stock is available from the suppliers. And with that kind of information, it’s amazing how mistakes can be avoided. Establishing these new strategies around data is an opportunity that a lot of retailers can benefit from enormously.

On a related note, I think a lot of smaller regional retailers may say, “Oh, but that’s just for the big guys,” and I push back on that. There are great examples of smaller companies that have made these sorts of investments in data management and analysis that have led to significant improvements in savings. I disagree with the notion that implementing the ideas I’m talking about can only be done by the biggest retailers with the most power.

I would share one additional strategy with retailers for adapting to volatility and consumer trends. I think most retailers could go further in terms of enhancing and improving their value-added, ready-to-eat, ready-to-heat products in the store, for a few reasons. Number one is that over time, consumers have proven themselves to have a higher willingness to pay for those sorts of prepared foods. For better or for worse, people increasingly want to save time and effort while eliminating confusion and uncertainty. Therefore, consumer spending on food away from home, meaning restaurants, had overtaken groceries (food at home) as the number-one marketing channel in the U.S. pre-COVID.

We know COVID changed that game fast, yet I’m skeptical on how long cooking at home is going to last. Now that people increasingly can go back to eating out and eating prepared foods, they’re doing it. They have a higher willingness to pay for it, and they’re increasingly open to these shopping trips, or they’ll say, “Okay, yeah, I’ll buy the groceries for the week and I’ll get the stuff to make dinner tomorrow, Wednesday, and Thursday, but oh, hey, tonight let’s have a rotisserie chicken. It’s ready to go.”

And, in my opinion, the supply side of this shift in retailers’ structure is more interesting, because increasingly retailers of all sizes, of all stripes, are engaging in vertical integration. I think there’s tremendous opportunity when retailers have direct access to products, particularly specialty crops. Here’s how this plays out: When the retailer has too many commodities (i.e., too many fruits, vegetables, nuts, whatever), it’s increasingly possible and common to repurpose the products that aren’t selling in bulk. The win is that these processed products present higher-margin offerings. Examples include your party trays for the big game, fresh smoothies, and baked goods. One of my favorite retailers makes an apple cinnamon pie with apples that were deemed too ugly to sell in fresh produce. That’s a complete win-win, eliminating the waste of apples and creating this high-margin product that people love that drives brand differentiation.

So, I really think this type of vertical integration and repurposing of specialty crops is the wave of the future. Yet, I think a lot of retailers, especially smaller and medium-sized retailers, may still have this idea that prepared foods are risky, the associated costs are too high, and labor is too tight. But these types of investments in terms of the infrastructure of the store and the training of the employees will more than pay for themselves in our modern American economy, and they will also significantly reduce food waste. I think the writing is on the wall—most food retailers are already pursuing this value-added strategy, but I also think we are nowhere near the ceiling of where prepared foods at the grocery store are going to go.

Then there’s the third element, in addition to reducing costs and food waste, which is that now you’re making something that nobody else has. Differentiation is the name of the game. How do you set yourself apart from competitors? Well, that’s one great way—vertical integration, product conception, private labels, perimeter offerings, all that sort of stuff.

All this research and strategy is ultimately about getting the information to retailers in a trusted setting. That’s where I think trade associations can be so critical in helping the industry adapt to climate change and other COVID-like disruptions. This type of education for retailers depends on that exposure; that’s where I think the conversation should be happening.

Yeah, I feel that aspect of differentiation and data speaks to the work that we’ve been leading with Ratio Institute’s certification program. I want to go back to your work at Cal Poly. How has interest in the food retail industry shown up in your students?

Well, I find food retailing so endlessly fascinating, and I have ever since I started my graduate studies way back in 2003 at University of Massachusetts Amherst. I was exposed to the industry at a super interesting point in time, when dynamics of price competition and consumer welfare were really taking off because large retail companies were expanding quickly on the national level. But what does that mean for their competitors? I’m not here to talk about my thesis, but that got me thinking there’s so much more than meets the eye.

Most of my students come to Cal Poly with this idea that food retail is an incredibly simple industry, asking me, “What is so complicated about buying a case of Campbell soup? The retailer pays $1.50; they charge $2.00 a can—when you’re almost out, you order more, bam—rinse and repeat.” I relate to that initial innocence, so my number-one instructional goal is to correct students of that notion and enlighten them on how complex and fascinating the industry is. My motivation for my specific curriculum is that because Cal Poly is a very, very applied program, most of our alumni go into industry. And, since we are the Agribusiness Department, our purview is the entire food supply chain.

We have plenty of students who are interested in agricultural production, processing, and pest control, and yet my interest lies in the downstream sector, so I work every day to get students engaged because I want them to pursue careers in that sector and be motivated by the complex, challenging, interesting questions at that frontier. The solutions they help design are going to drive gains for all sectors of our economy: for consumers, for producers, for agricultural producers, for the retailers themselves. I do my very best to open their eyes to the food retail industry’s biggest issues. What do we know? What don’t we know, and how can they get involved from the inside?

That’s awesome. How do you do that in application? Are there industry partnerships that help create these experiential learning opportunities?

Yes, the California Grocers Association (CGA) has been instrumental to helping expose my students to the industry, predominantly through the CGA Educational Foundation. They’ve been a long-term supporter of our department, and they’ve provided amazing opportunities for our students. There are three ways that they support my goal: research, industry events and exposure, and career fairs.

For research support, they help ensure that the students can be paid to work on projects that are of interest to CGA. We get to ask CGA each year, what do you want to learn more about? What are your interests? What do you need? And then the students work on those areas, bringing forth innovative results and solutions.

One of the coolest things that happens each year is that the retailers go to the capitol in Sacramento to address key regulatory issues that have the potential to affect them. It’s incumbent upon CGA members to advocate for the economic importance of their sector. Before our partnership was formed, they didn’t have the level of economic analysis that our department and students provide. Now they’re able to come and say, “For your legislative district, here’s how many people we employ. Here is how much we contribute to the tax base. Here’s our total revenue. Here’s the total food assistant benefit redemption. These stats matter.” While we’re not involved in the resulting legislative conversations, at least CGA has statistical evidence of their industry’s impact. On our end, the students sometimes get the research bug. It’s a great experience.

The second method by which CGA supports Cal Poly students is through inviting our students and faculty to attend their key events, which provides an impactful chance for students to get to know industry reps and hear their stories directly.

Then, finally, CGA visits my class and takes part in Cal Poly’s career fairs. They bring visualizations of their data and share about their issues. It provides a meaningful opportunity for the students to learn about how they can apply these theories to their eventual careers.

Overall, being in California, the nation’s agribusiness hub, I’d be nuts to only let myself lead my classes. I try to have three or four really cool guest speakers come in. They can include wholesalers, CGA, food producers and farmers, and more. They all share real data, and the students can ask them questions directly. These folks know their industry better than I do, and it’s a win for everybody since we all have the common goal of ensuring the retail sector will thrive and become more efficient.

That type of professional experience is so valuable, while simultaneously helping the industry—I can’t imagine the impact that’s had for retailers. For the students, it provides a unique experience that doesn’t just result in a grade on their term papers.

We’ve covered a lot, and I see we’re up to the hour, so is there anything else you’d like to share? Are there emerging topics that you’re hoping to start working on?

I can tell you that, largely because of funding that I’ve been fortunate to receive, my research portfolio for the next three to five years will focus heavily on understanding mergers and acquisitions in the food supply chain. We started the conversation talking about consolidation, and I cannot stress enough that in a very short period of time, our food supply chain has become very consolidated, and we don’t know what that means. COVID played a role in showing how that can lead to some serious problems. For example, one major meat processing facility shutting down for a week can lead to shortages and price jumps across the country for pork, which is concerning. In my opinion, based on my economic training, those sorts of acute issues are just the tip of the iceberg. We don’t know what consolidation has meant and will mean for labor markets, food prices, food quality, product assortment, price variation, food access through the benefits to assist the poor, the agricultural production sector, imports, exports, and more; there’s so much that we don’t know.

So, I’m putting my nose to the grindstone and working with some fantastic colleagues at Cal Poly, the USDA’s Economic Research Service, Colby College, and other institutions. We’re using a combination of publicly available datasets and proprietary store scanner datasets that we have access to through ERS to analyze these trends. Once we have results ready to publish on all these topics, I want to get it out there, so stay tuned.